In my previous blog post, we explored the composition changes of the S&P 500 Index, the most well-known barometer of the U.S. stock market, over the years. Now, in 2024 Technology represent the largest segment of the S&P 500 Index, accounting for nearly 30% of the index. For those who want a greater exposure to the booming technology sector, we also reviewed the 3 largest broad technology ETFs by assets under management (AUM): QQQ, VGT, and XLK. This week we reviewed Nvidia and discussed if you should invest in this explosive growth stock. This week, we also observed Nvidia becoming the world's most valuable company and discussed actionable insights for investors. Today we will explore an alternative way to invest in Nvidia and the booming semiconductor segment.

What?

Investing in Nvidia, a leading player in the semiconductor and AI industries, can be volatile due to the company’s individual stock price movements. For investors looking for exposure to Nvidia with potentially less risk, ETFs like the VanEck Semiconductor ETF (SMH) present an alternative. SMH includes Nvidia as a significant holding, providing indirect investment in the company while diversifying the risk across multiple semiconductor stocks.

So What?

Reduced Volatility: Nvidia's stock is known for its high volatility, which might not suit all investors. SMH provides a more stable investment option by diversifying across other semiconductor companies.

High Exposure to Nvidia: As of 6/19/2024 SMH allocates around 25% of its portfolio to Nvidia, ensuring significant exposure to its growth potential. See the table below the top 10 holdings of SMH for details. Also note that the top 10 holding posted substantial gains this year.

Diversification Benefits: Besides Nvidia, SMH includes other key players in the semiconductor industry like Taiwan Semiconductor Manufacturing Company and Intel, which helps in spreading risk and reducing dependence on a single stock.

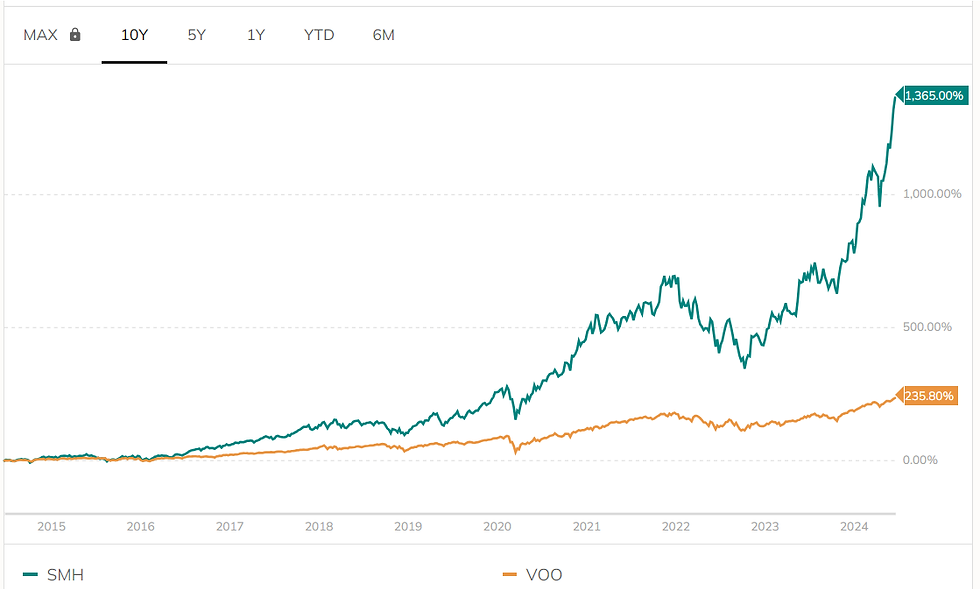

Proven Track Record: SMH has a strong performance history, offering significant returns over the past decade, and has been less volatile compared to Nvidia's stock alone. The chart below the 10-year performance of SMH compared to the well-known S&P 500 ETF from Vanguard (VOO). SMH delivered outstanding performance against the S&P 500 ETF although it had to go through volatile roller-coaster rides at times.

Balanced Portfolio: The ETF's diversified nature makes it a safer choice for investors seeking exposure to the semiconductor sector while maintaining a balanced portfolio.

Now What?

Evaluate Risk Tolerance: Assess your own risk tolerance to determine if the volatility of individual stocks like Nvidia fits your investment strategy.

Consider SMH for Diversification: If you are looking for a way to invest in Nvidia with less risk, consider adding SMH to your portfolio for its diversification benefits.

Monitor Market Trends: Stay informed about market trends in the semiconductor industry to make timely investment decisions.

Review Performance: Regularly review the performance of SMH to ensure it aligns with your investment goals and risk appetite.

Long-Term Perspective: Consider SMH as a long-term investment to take advantage of the growth in the semiconductor sector while mitigating short-term volatility.

Consult with a Financial Advisor: Seek advice from a financial professional to ensure that investing in SMH aligns with your overall financial strategy and goals.

Concluding Remarks

ETFs like SMH present a viable option for gaining exposure to Nvidia with reduced risk. SMH is ideal for those looking for significant exposure to the semiconductor sector while enjoying the benefits of diversification. Investors should consider their risk tolerance, investment goals, and market outlook when deciding to include SMH in their investment strategy. Consulting with a financial advisor can provide personalized guidance to ensure this investment aligns with your broader financial plan.

Comments