In our previous discussions, we highlighted the potential of bond funds/ETFs to offer steady cash flow as an alternative annuities. Building on that, we explored the Fidelity Total Bond ETF (FBND) as an example of high-quality and low-cost core bond funds. Today, we extend this exploration to the PIMCO Income Fund (PIMIX), further enriching our toolkit for retirement income generation.

What?

PIMIX, the PIMCO Income Fund, is designed to maximize current income while seeking long-term capital appreciation through a diversified portfolio of fixed income instruments. These instruments span various sectors, including government and corporate bonds, both domestically and internationally, as well as mortgage-related and other asset-backed securities. The fund has shown a strong performance with a consistent focus on income generation, backed by a diversified approach to minimize risks associated with income investing.

So What?

Let's look at the details of the PIMCO Income Fund (PIMIX):

Fund Inception: 3/30/2007

Net Assets: $143 Billion (As of 3/28/2024)

Expense Ratio: 0.62%

TTM (Trailing 12 Months) Yield: 6.60% (As of 2/29/2024)

Total # of Holding: 9129

Morningstar Category: Multisector Bond

Morningstar Style (Bond):

Credit Quality: Low - Mid - High

Interest-Rate Sensitivity: Limited - Moderate - Extreme

Top 3 Exposure: Government (33%), Securitized (25%), Cash & Equivalent (24%)

Minimum initial investment: $1 Million

Morningstar Star Rating: 5 Stars (Best = 5 Stars)

Morningstar Medalist Rating: Gold (Best = Gold)

As of March 28 2024, the PIMCO Income Fund (PIMIX) has the largest assets under management (AUM) of any active bond fund at $143 Billion. There are many reasons why PIMIX is the king of all the active bond funds out there. Through thick and thin, the PIMCO Income Fund has delivered in nearly every case. It stands out in the multisector bond category for its strategic and balanced investment approach, underlined by its impressive perfect Morningstar ratings. Its diversified portfolio and focus on government securities, securitized assets, and cash equivalents demonstrate PIMCO's commitment to both stability and income generation.

The only catch here is the minimal initial investment of $1 million since this is an institutional class. You could potentially bypass this requirement since some asset managers and financial advisors pool investments to meet this requirement. For example, it appears that Schwab allows minimum initial investment of $2,500 for basic and $1,000 IRA/custodial accounts, and $1 for subsequent investment.

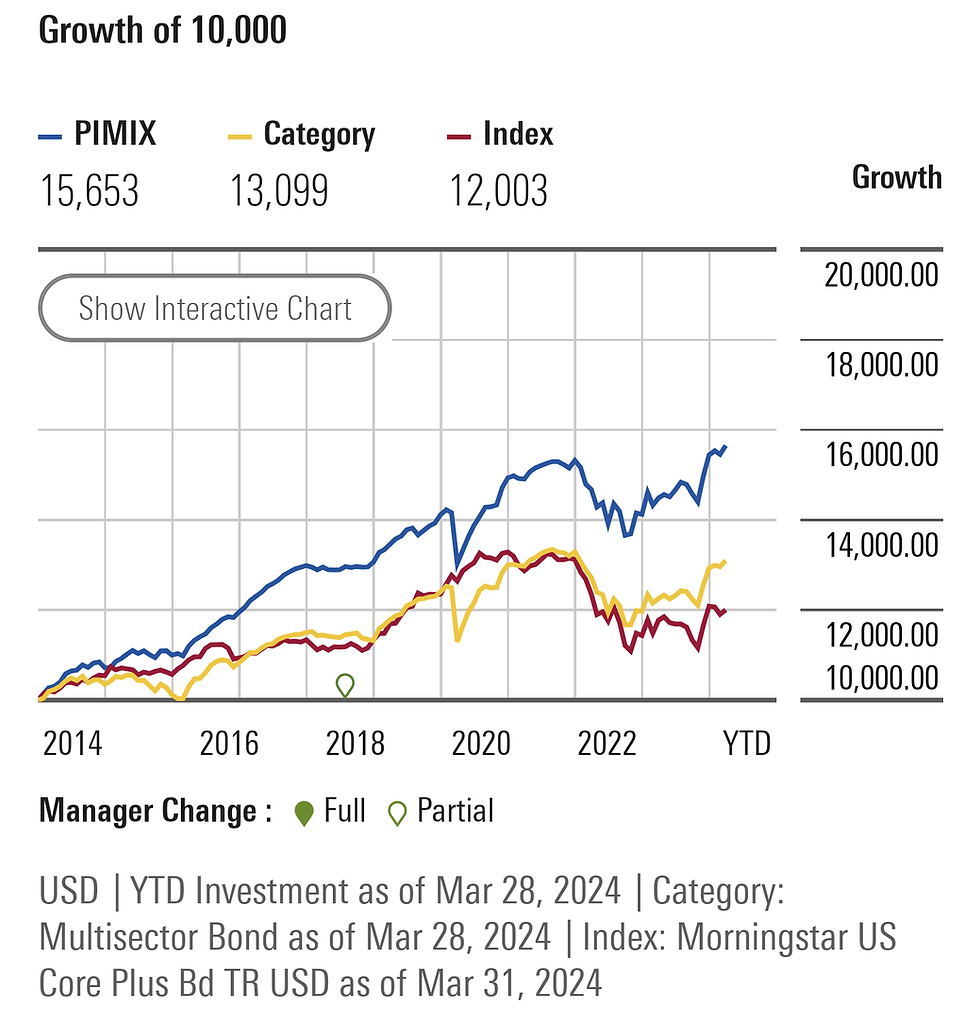

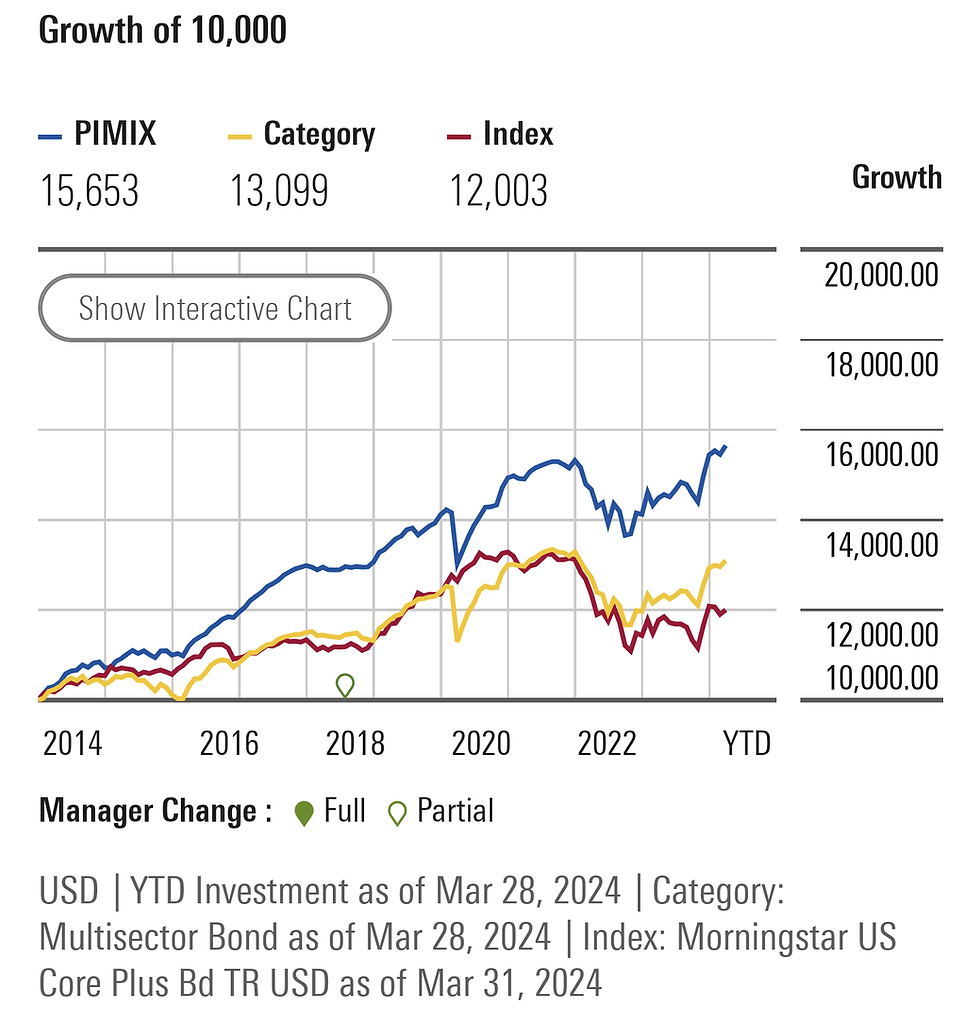

The chart above from Morningstar shows the growth of $10,000 investment for the past 10 years. PIMIX has clearly outperformed the Multisector Bond Category and the Morningstar US Core Plus Bond Index. PIMIX also outperformed FBND (Fidelity Total Bond ETF), which we explored in our last post, for the past 10 years.

Now What?

Evaluate Your Portfolio: Take a look at your current investments. How does PIMIX fit in? Its focus on income and growth could complement your existing portfolio, especially if you are nearing retirement and are looking to diversify or strengthen your bond exposure.

Consider the Minimum Investment Workaround: Don’t let the $1 million minimum scare you off. Consider those asset managers and financial advisors that allow investors to start with much less. This can be a great way to access a high-caliber fund like PIMIX without needing to meet the hefty institutional investment threshold directly.

Consult a Financial Advisor: If PIMIX seems like a good fit, it might be time to talk to a professional. A financial advisor can give you personalized advice, taking into account your investment goals, risk tolerance, and how PIMIX can integrate with your overall financial plan.

Concluding Remarks

The PIMCO Income Fund distinguishes itself not just through its commitment to high, consistent income, but also through its remarkable performance stability and impressive scale, boasting the largest size in terms of assets under management (AUM) among its peers. This fund is a beacon for investors seeking reliability in their income-focused investments, leveraging a diversified, multi-sector strategy that has proven its worth over time. As with any investment, it's essential to align the fund's characteristics with individual investment goals and risk tolerance.

Comments